IVIVC and Waivers: How In Vitro Methods Are Replacing In Vivo Testing for Bioequivalence

Feb, 7 2026

Feb, 7 2026

For decades, proving that a generic drug works the same as the brand-name version meant putting healthy volunteers through blood draws, fasting periods, and long clinic visits. These in vivo bioequivalence studies cost hundreds of thousands to over a million dollars per trial and took months to complete. Today, a growing number of generic drug approvals are skipping human testing entirely - not because they’re cutting corners, but because science has found a smarter way. In Vitro-In Vivo Correlation (IVIVC) is turning lab-based dissolution tests into reliable predictors of how a drug behaves inside the body.

What Is IVIVC, Really?

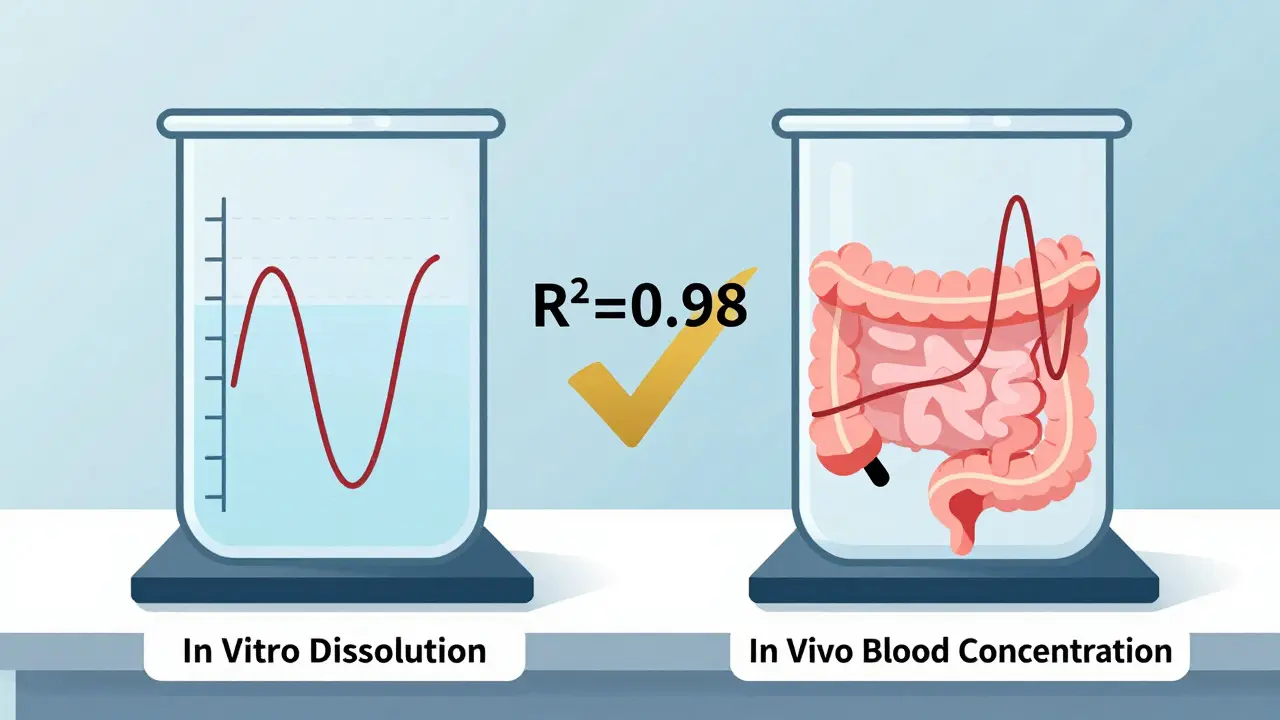

At its core, IVIVC is a mathematical model that links two things: how fast a drug dissolves in a test tube (in vitro) and how fast it gets absorbed into the bloodstream (in vivo). If the dissolution profile matches the drug’s absorption pattern, regulators can trust that a change in the pill’s formulation won’t change how well it works. That’s the magic. It’s not just about dissolving faster - it’s about dissolving in a way that mirrors what happens in the stomach and intestines.

The U.S. FDA first laid out the rules in 1996 and updated them in 2014. The European Medicines Agency followed with similar standards. Both now accept IVIVC as a valid basis for waiving human bioequivalence studies - but only if the model is strong enough. A Level A correlation, the gold standard, must predict the full absorption curve point-by-point. That means if the drug dissolves 20% at 30 minutes, 50% at 2 hours, and 80% at 4 hours in the lab, those exact numbers must line up with how much drug shows up in blood at those same times in people. The correlation needs an R² value above 0.95. No wiggle room.

Why Bother With IVIVC?

Cost and time are the biggest drivers. A single bioequivalence study with 24 volunteers can run $750,000 to $1.5 million. For a generic company launching multiple products, that adds up fast. IVIVC changes the game. Once validated, a single model can support dozens of post-approval changes - like switching manufacturers, tweaking excipients, or scaling up production - without repeating human trials. Teva saved five full bioequivalence studies for their extended-release oxycodone generic by building a solid IVIVC. That’s over $4 million in savings.

But it’s not just about money. Human testing is ethically and logistically tricky. It requires healthy volunteers, strict controls, and regulatory oversight. For complex modified-release products - like those designed to release drug slowly over 12 or 24 hours - IVIVC offers a more precise, repeatable way to ensure consistency. It’s also faster. While a bioequivalence study takes 6-9 months, building an IVIVC model can be done in 12-18 months, and once it’s approved, future changes are approved in weeks.

Not All Drugs Can Use IVIVC

IVIVC isn’t a universal fix. It only works for drugs with predictable, consistent absorption. If a drug is absorbed in a patchy way - because of food effects, unstable pH, or erratic gut movement - the model breaks. The FDA explicitly says IVIVC shouldn’t be used for drugs with a narrow therapeutic index (like warfarin or digoxin) or those with nonlinear pharmacokinetics.

For simple immediate-release pills, there’s an easier path: the Biopharmaceutics Classification System (BCS). If a drug is highly soluble and highly permeable (Class I), regulators may waive bioequivalence studies without any IVIVC. But for extended-release tablets, patches, or complex formulations, BCS doesn’t cut it. That’s where IVIVC becomes essential.

How Is IVIVC Built? The Real-World Steps

Building a valid IVIVC isn’t a one-step process. It takes time, money, and precision. Here’s how it actually works:

- Develop a discriminatory dissolution method - The test must detect small differences in formulation. Using standard water isn’t enough. Biorelevant media - which mimic stomach acid, bile, and intestinal fluids - are now required. A 2019 University of Maryland study showed that traditional dissolution methods failed to predict real-world performance in 60% of complex products.

- Create multiple formulations - You need at least three versions of the drug: one fast-releasing, one slow, and one matching the brand. Each must be tested in humans to get pharmacokinetic data.

- Run pharmacokinetic studies - Each formulation needs data from 12-24 volunteers, with blood drawn every 30 minutes for 24-48 hours. That’s 12+ time points per person.

- Build and validate the model - Statistical software links dissolution data to blood concentration curves. The model must predict AUC within ±10% and Cmax within ±15% of actual human results.

- Submit to regulators - The FDA reviews everything. In 2022, only 42% of submissions were approved - up from 15% in 2018, but still a high failure rate.

Companies that fail often do so because they skip steps. A 2022 survey of 47 generic manufacturers found that 76% didn’t test enough formulation variations. Another 63% used non-discriminatory dissolution methods. Without these, the model is just guesswork.

Where IVIVC Is Working - And Where It’s Not

The success rate varies wildly by drug type:

| Product Type | Approval Rate | Key Challenges |

|---|---|---|

| Oral Extended-Release | 58% | Ensuring consistent release over 12+ hours |

| Complex Injectables | 32% | Stability, particle size, and absorption variability |

| Ophthalmic Products | 19% | Difficulty measuring local absorption |

| Immediate-Release (BCS Class I) | 85%+ (via BCS waiver) | Not applicable - IVIVC not needed |

Companies like Teva, Sandoz, and Sun Pharma have dedicated IVIVC teams. Smaller firms often outsource to contract labs like Alturas Analytics or Pion, which report success rates of 60-70% when brought in early. But if you wait until the last minute to start, your chances drop below 20%.

The Future: AI, Biorelevance, and Global Harmonization

IVIVC is evolving. The FDA and EMA are now exploring machine learning models that can predict absorption patterns from dissolution data without traditional regression. In 2024, both agencies held joint workshops on AI-enhanced IVIVC - as long as the models remain transparent and scientifically justified.

Biorelevant dissolution is becoming standard. By 2025, the American Association of Pharmaceutical Scientists predicts 75% of new IVIVC submissions will use media that mimic real gut conditions. That’s a big shift from testing in plain water or buffer solutions.

Regulators are also expanding IVIVC beyond oral drugs. Draft guidance released in June 2023 opens the door for IVIVC in topical creams, transdermal patches, and even implantable devices. If this takes off, it could eliminate hundreds of human trials for non-oral products each year.

By 2027, McKinsey & Company estimates IVIVC-supported waivers will cover 35-40% of all modified-release generic approvals - up from 22% today. That’s not just progress. It’s a transformation.

Why This Matters for Patients and Providers

At first glance, IVIVC sounds like a technical issue for drugmakers. But it affects everyone. Faster approval of generic drugs means lower prices and better access. When a company can avoid a $1 million bioequivalence study, that savings gets passed on. IVIVC also improves quality control. Instead of testing one batch after another in people, manufacturers can monitor every batch with a simple dissolution test.

For pharmacists and prescribers, it means more confidence in generics. If a drug has an approved IVIVC, you know its performance has been rigorously tied to the brand - not just assumed. And for patients, especially those on long-term therapies, it means fewer disruptions in supply. When a manufacturer changes a production line, IVIVC allows quick approval without waiting months for human trials.

What’s the difference between IVIVC and BCS waivers?

BCS waivers apply only to immediate-release drugs that are highly soluble and highly permeable (Class I). They don’t require any dissolution modeling - just proof of BCS classification. IVIVC, on the other hand, is used for complex formulations like extended-release tablets, where absorption can’t be predicted by solubility alone. IVIVC needs extensive testing and modeling; BCS does not.

Can IVIVC be used for all generic drugs?

No. IVIVC is only suitable for drugs with predictable absorption. It’s not allowed for narrow therapeutic index drugs (like lithium or phenytoin), drugs with nonlinear pharmacokinetics, or products with erratic absorption due to food, pH, or gut motility. For most simple immediate-release drugs, BCS waivers are simpler and more common.

Why do so many IVIVC submissions fail?

The top three reasons are: 1) Dissolution methods aren’t discriminatory enough - they can’t tell the difference between good and bad formulations; 2) Too few formulation variations were tested, so the model doesn’t cover real-world changes; and 3) The dissolution conditions don’t match real gut physiology. Using plain water instead of biorelevant media is a common mistake that leads to rejection.

Is IVIVC only used in the U.S.?

No. The European Medicines Agency (EMA) accepts IVIVC for biowaivers, and other regulators in Canada, Japan, and Australia follow similar guidelines. However, approval rates vary. The U.S. has the highest number of accepted IVIVC submissions, partly because of longer experience and more industry investment.

How long does it take to build a successful IVIVC?

A typical Level A IVIVC takes 12-18 months. About 3-6 months is spent developing the dissolution method, 6-9 months on human pharmacokinetic studies, and 3-6 months on modeling and regulatory submission. Rushing any step increases the risk of failure.

Final Thoughts

IVIVC isn’t a shortcut - it’s a smarter path. It demands more science upfront, but pays off with fewer human trials, faster approvals, and lower costs. The regulatory agencies aren’t just accepting it - they’re pushing for it. As biorelevant testing and AI modeling improve, IVIVC will become the norm, not the exception. For generic drugmakers, it’s no longer optional. For patients, it’s a quiet win: better access to affordable medicine, without compromising safety or efficacy.

Lakisha Sarbah

February 8, 2026 AT 21:33Ariel Edmisten

February 10, 2026 AT 12:06Patrick Jarillon

February 11, 2026 AT 22:21Niel Amstrong Stein

February 12, 2026 AT 11:02Paula Sa

February 14, 2026 AT 00:52Mary Carroll Allen

February 15, 2026 AT 07:33Joey Gianvincenzi

February 15, 2026 AT 10:31Sarah B

February 16, 2026 AT 12:19Eric Knobelspiesse

February 18, 2026 AT 04:05Heather Burrows

February 20, 2026 AT 01:12Ritu Singh

February 21, 2026 AT 05:20Mark Harris

February 22, 2026 AT 15:12Savannah Edwards

February 23, 2026 AT 00:37